In today’s financial world, your credit score is more than just a number—it’s a key that unlocks opportunities. As a student, building a strong credit score early can help you qualify for better loan rates, credit cards, housing, and even job opportunities in the future. But many students don’t learn about credit until it’s too late, resulting in poor financial decisions that affect them for years.

This article is your complete guide on how to build a good credit score as a student in 2025. We’ll break down what a credit score is, why it matters, and the actionable steps you can take to grow it steadily—even with a limited income. Whether you’re in your first year of college or about to graduate, it’s never too early (or too late) to start building healthy financial habits that contribute to a strong credit profile.

Table of Contents

What is a Credit Score?

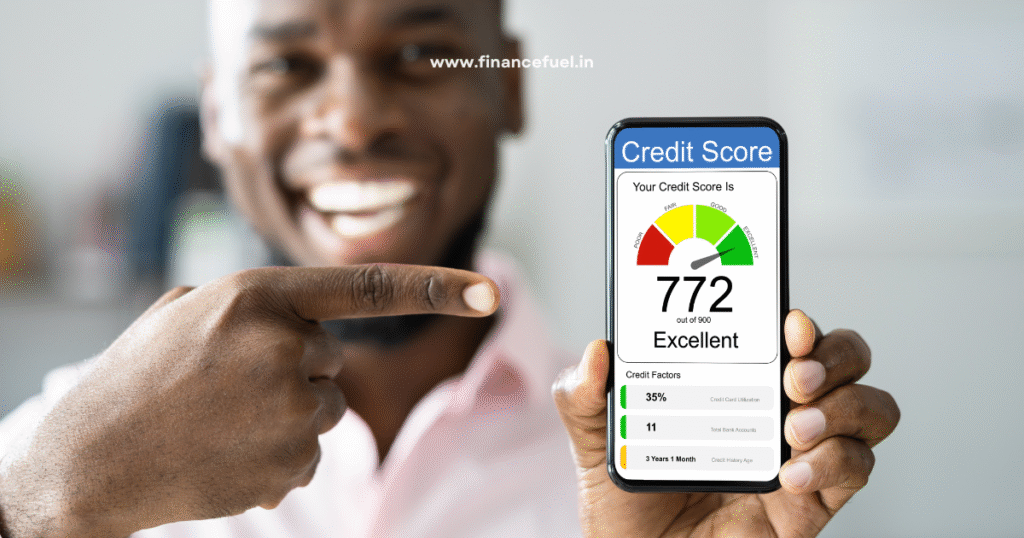

A credit score is a three-digit number that reflects your creditworthiness—how likely you are to repay borrowed money. Lenders use it to decide whether to approve you for credit cards, loans, or even renting an apartment. The most commonly used score is the FICO Score, which ranges from 300 to 850.

Your credit score is calculated based on several factors: your payment history (35%), credit utilization (30%), credit history length (15%), credit mix (10%), and new credit inquiries (10%). Understanding these elements will help you make smarter decisions when using credit.

Why Should Students Care About Their Credit Score?

As a student, you might think your credit score doesn’t matter until after graduation—but that’s a common misconception. A good credit score can help you get lower interest rates on student loans, qualify for better housing options, and even get approved for a car loan or job after college.

Furthermore, starting early allows you to build a longer credit history, which positively impacts your score. It’s like planting a financial seed: the earlier you start, the more time your score has to grow and mature.

Step 1: Open a Student Credit Card

One of the easiest ways to start building credit is by getting a student credit card. These cards are designed specifically for people with little or no credit history. They often come with lower credit limits and may include rewards like cashback or student-friendly perks.

When you use your credit card responsibly—by making small purchases and paying them off in full—you start building a positive credit history. Avoid maxing out your card or missing payments, as these actions can damage your score quickly.

Step 2: Become an Authorized User

If you’re not ready to open your own credit card, becoming an authorized user on a parent or guardian’s credit card is a great option. As an authorized user, you’ll benefit from their positive credit history, which can help build your own score.

Make sure the primary cardholder has a solid payment record and low credit utilization. Their habits will reflect on your credit report, so only join accounts that are being managed responsibly.

Step 3: Always Pay Your Bills on Time

Your payment history makes up 35% of your credit score, so paying bills on time is crucial. This doesn’t just apply to credit cards—it also includes rent, student loans, mobile phone bills, and utility payments.

Consider setting up automatic payments or reminders to ensure you never miss a due date. Even one late payment can significantly drop your score and stay on your report for up to seven years.

Step 4: Keep Your Credit Utilization Low

Credit utilization refers to the amount of credit you use compared to your total credit limit. A good rule of thumb is to keep your utilization below 30%. For example, if your credit limit is ₹10,000, try not to spend more than ₹3,000 at a time.

Maintaining low utilization shows lenders that you’re not overly dependent on credit. This also keeps your credit score healthy and allows room for emergencies.

Step 5: Don’t Apply for Too Much Credit at Once

Every time you apply for a credit card or loan, a “hard inquiry” is made on your credit report. Too many hard inquiries in a short time can signal to lenders that you’re desperate for credit, which may lower your score.

Be selective about the credit products you apply for. Do your research beforehand to ensure you’re likely to be approved before applying. Consider spacing out applications by at least six months.

Step 6: Use a Secured Credit Card (if Needed)

If you’re unable to get approved for a regular credit card, a secured credit card is a great alternative. These require a refundable deposit that acts as your credit limit, minimizing the risk to the lender.

Using a secured credit card the same way you would a normal one—small purchases and full monthly payments—will help you build credit until you’re eligible for an unsecured card.

Step 7: Check Your Credit Report Regularly

It’s important to monitor your credit report to catch errors, fraudulent activity, or outdated information. In India, you can get one free credit report per year from credit bureaus like CIBIL, Experian, or CRIF High Mark.

Checking your credit report regularly helps you understand how your actions affect your score and allows you to dispute any mistakes promptly.

Step 8: Don’t Close Old Credit Cards

Your credit history length accounts for 15% of your credit score. Keeping older accounts open—even if you don’t use them often—helps increase your average account age.

Closing a card can also impact your credit utilization ratio if it reduces your total available credit. Instead of closing old accounts, consider using them occasionally to keep them active.

Step 9: Diversify Your Credit Types

Lenders like to see that you can manage different types of credit. This might include a student loan, credit card, and auto loan. You don’t need to take out multiple loans just to build credit—but if you already have a student loan, managing it well helps your credit score.

In the future, consider mixing secured and unsecured credit accounts to boost your credit profile and score over time.

Step 10: Use Credit Responsibly During Emergencies

It can be tempting to rely on credit cards during tough times, but using too much credit all at once can hurt your score. Emergencies do happen, but it’s better to have a small savings fund for such situations rather than maxing out your card.

That said, using your credit card for a medical or travel emergency and repaying it promptly is perfectly fine and can even help your credit score if handled responsibly.

Common Credit Mistakes Students Should Avoid

Many students unknowingly make credit mistakes that can take years to fix. One major mistake is missing payments, even by a day. Another is using more than 50% of your available credit limit or maxing out your card.

Avoid co-signing loans for friends, applying for multiple cards at once, or withdrawing cash using your credit card—these actions can quickly lead to debt traps and a declining credit score.

Tools and Apps to Track Credit as a Student

Today, there are several apps and websites that allow you to track your credit score, receive reminders, and get personalized tips. Apps like CRED, OneScore, and Bajaj Finserv Credit Pass in India help you monitor and improve your credit.

Using these tools can help you stay accountable and aware of your financial decisions, making it easier to build strong credit habits as a student.

Benefits of a Good Credit Score After Graduation

A strong credit score can set you apart after college. Whether you’re applying for a home loan, renting a flat, buying a vehicle, or starting a business, a high credit score saves you money through lower interest rates and better terms.

Employers in some industries may even check your credit report during the hiring process. Building credit now gives you a head start in the adult world where financial credibility plays a big role.

Final Thoughts: Start Small, Think Long Term

Building a good credit score as a student doesn’t require earning a lot of money—it just requires discipline, patience, and smart decision-making. The habits you form now will influence your financial future for decades.

Start small: get a student or secured credit card, pay it off on time, and stay within your means. Over time, these small steps add up to a strong, healthy credit profile that opens doors to greater financial opportunities.

Did You Know?

Even something as simple as paying your Netflix or Spotify subscription on time with your credit card can help build credit—if reported to credit bureaus. Always pay attention to the small things!

If you found this guide helpful, share it with your friends and classmates. The earlier you start, the better your financial future looks.